Credit Karma says that it will give you your credit score and credit report for free if you sign up for an account. Is this information going to be correct or reliable when it comes to it? Does Credit Karma have the same information as lenders if they want to give you a home or car loan? Does it offer something that you can't get anywhere else? The first thing you need to know is what Credit Karma is and what it does. You also need to understand how VantageScore is different from the FICO score you're more used to seeing on your credit cards. Here we will do a complete Creditkarma.com review. Keep on reading to learn more.

What Is Credit Karma?

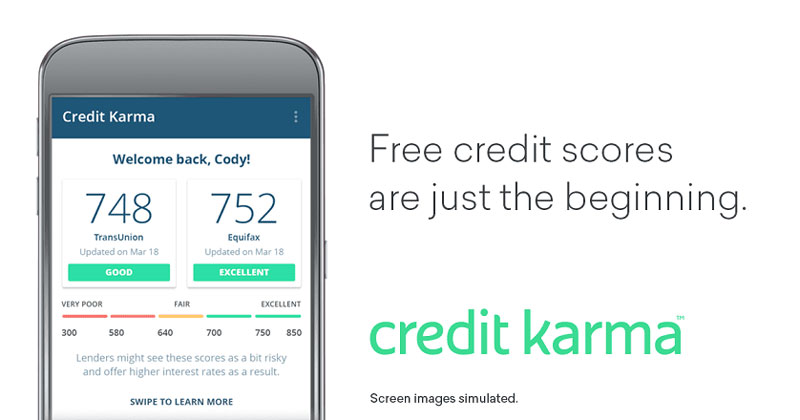

Many people know about Credit Karma because it gives people free credit scores and credit reports, so many people use it. That's not the only thing it sees itself as. It sees itself as a website that lets its users "build a better financial future." If you want to use Credit Karma, the company needs your name and the last four digits of your Social Security number for you to do so. Credit Karma then looks at your credit reports, comes up with a VantageScore, and gives it to you. You give them your permission to do this.

Who Owns Credit Karma?

It was started by Kenneth Lin, Ryan Graciano, and Nichole Mustard in 2007. They started the company in 2007. When they started the company in 2007, they did so. In this case, Lin is the CEO, Graciano is the company's CEO, and Mustard is the CEO of the company, as well. For cash of $3.4 billion and 13.3 million stocks of Intuit assets and equity honors valued at $4.7 billion, Intuit purchased Credit Karma in December 2020.

Services Credit Karma Provides

TransUnion and Equifax are two of the three main credit bureaus. Credit Karma will get your credit information from these two. This game will use a score from VantageScore to develop its score. Your VantageScore score and the more detailed credit reports that go with it will come in the next step. Even though this free service is offered by Credit Karma, they also provide other services that go along with it, like a security monitoring service and alerts when someone checks your credit report.

Then, as soon as you give Credit Karma your information, you can search for a credit card, a car loan, or a home loan with personalized offers. Your search won't appear in your credit report on Credit Karma or anywhere else. Credit reports show which lenders you've tried to get a loan from and how many times each one has asked for your report. When you use Credit Karma, you can limit how many times you want to ask for help.

Is Your Credit Karma score correct?

Bethy Hardeman used to work for Credit Karma as the company's customer advocate. People who use Credit Karma get their scores and credit report information from TransUnion and Equifax, two of the three major credit bureaus. Our VantageScore credit scores aren't from either significant credit bureaus. CK chose VantageScore because it is a joint effort by all three major credit bureaus and is an open scoring model that can help people better understand changes to their credit score.

If you have a bad credit score, Credit Karma is not a credit bureau. This means that they don't get information from lenders. Using Credit Karma, you can see your credit score and report based on what TransUnion and Equifax say about you. There are no guesses about your credit score when these scores are used. This makes them more accurate and reliable.

Is It Secure to Use Credit Karma?

Yes. It uses 128-bit encryption, which is thought to be very hard to break to keep its data safe. There is also a promise that it won't give your information to anyone else, too.

How Many Points Does Credit Karma Debit?

A few points, if any, is the only answer that makes sense. Because different models are used to figure out your credit score, you can have other scores based on which one is used. Your score can change if the VantageScore or FICO model is used, or if another model is used, and even which version of that model is used, your score can be different. Make sure you put this number where other numbers that show how bad, fair or good a person is are on a pie chart. This number is significant because it reveals whether or not a person is exceptional.

Bottom Line

Credit Karma is used by many people to keep an eye on their credit scores, and many people use it. The company is very open and uses VantageScore to give its services. When you look at your credit, it gives you a good picture of where you are now. To find mistakes in your credit report, you can also use Credit Karma look at your report, too. Keep an eye on your credit report and check it often to see if there are any mistakes or any information that is not true. Find out if there are any mistakes in your data before applying for a loan or a loan.